Q:What is trading a CFD on Margin?

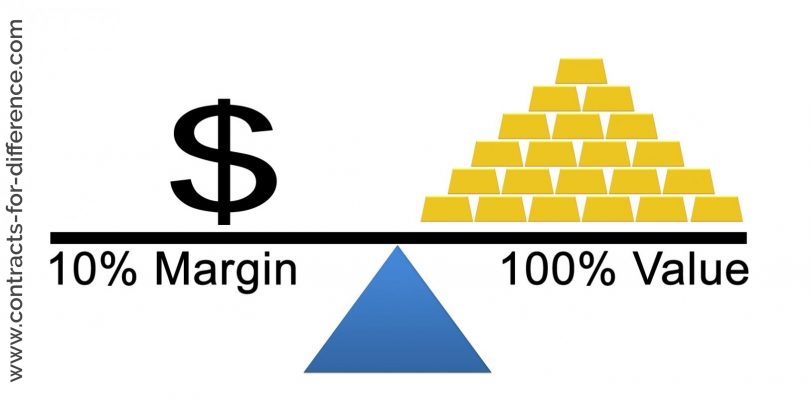

A: CFD trades are margin-based transactions with the gain/loss being set by the difference between the price the CFD is opened and the price at which it is closed. Margin refers to the deposit the stock market trader must provide in order to open a position. For instance, if Barclays has a margin of 10%, the investor can pay 10% of the total market position value while borrowing the remaining 90% from the CFD provider. In other words, the trader entering a contracts for difference trade is only required to put up a fraction of the total value of the specified contract traded. Margin money is essentially a guarantee that the person (trader/investor) will honour the contract entered into with the broker. Margin is set based on risk and on what it would cost to buy the investment for its full price. By trading on margin, the trader can create significant opportunities, since he only has to tie in a nominal deposit to hold a position, meaning that only a small proportion of the total value of a position is needed to trade allowing the client to magnify market exposure. i.e. the investor is acquiring a larger exposure to a particular stock for a reduced amount of money.Margin is thus the minimum deposit you are required to make by your CFD provider so you can open your CFD trade. Your risk level will depend upon your margin covering your margin trade. The amount required to initiate a new position (i.e. enter a trade) is referred to as ‘Initial Margin’. Initial margin is usually set at a percentage of the value of the contract being traded. The Margin is set by the CFD provider. It is important to note that trading ‘on margin’ significantly increases risk by magnifying the extent of potential losses which can exceed the initial investment.

Margin is a cash deposit provided by investors as collateral to cover losses (if any) that may result from their trades. Remember that even if you shop around for providers offering the lowest margin rates, you need to keep in mind that irrespective of how little margin you pay, you are always responsible for the full face value of the trades you make.

Example: CFD Trading on Margin

Suppose someone familiar with trading shares decides to start trading share CFDs. Suppose they research a given company and finds reason to believe that the company’s stock price is currently undervalued. Suppose the investor enters into a long position using a contract for differences over the company’s shares. The prevailing price of one CFD contract for the company’s shares quoted by the CFD broker is £4.50. Suppose for example, the investor wants to buy 10,000 CFDs at £4.50 per share CFD contract. The total market value of the contract amounts to £45,000 (= £4.50 x 10,000). The CFD broker requires a margin of 5% on the stock, so the deposit margin amounts to £2,250 (£45,000 x 0.05). The investor must pay this deposit margin to open their desired position. The broker also charges the investor 0.1% on the face value of the open and closing trades. Therefore to open the position, the investor is charged £45 (=0.001 x £45,000).

If the stock price rises, as expected, to say £6.00, the total face value of the position will be £60,000. Suppose the investor exits the position, a closing commission of 0.1% is charged, amounting to £60 in this case. The gain made by the investor is equal to (£60,000 minus £45,000) less (£60 + £45) = £14,895. This amounts to a 662% return on capital, since £14,895 is 662% of the initial margin, £2,250.

Now suppose the stock price fell against expectations to £3.00. The total face value of the position will be £30,000. Now suppose the investor closes the position. The investor will be charged 0.1% for closing commission, amounting to £30 in this scenario. The loss borne by the investor is equal to (£30,000 – £45,000) less (£30 + £45) = -£15,075. So the investor will be down £15,075. The return on capital in this case is -670%.

The example above does not take into account fees for holding positions overnight (or interest earned in the case of short positions), which will in practice affect the returns from trading CFDs. Notice for a given percentage change in the price of the stock, the losses are higher than the gains when trading on margin. For example, if the stock price rises to £6.00, the gain is £14,895 versus a loss of £15,075 if the stock price declines to £3.00. Also be aware that brokers who offer the lowest margin may not necessarily be the best choice.

Q:But why does a broker require you that you deposit a margin payment?

A: Well, the detail of it goes on something like this -:It has probably happened to you more than a couple of times that as a result of taking a bet from a friend or co-mate, you end up being owed an expensive bottle of champagne but never end up receiving your due…

This is cited to as credit risk in banking terms. If an investor buys a leveraged share CFD with a broker, it can only result in three possible outcomes:

1. Both parties owe no cash. You are happy. The broker is happy.

2. The broker owes you money. You are happy. The broker is unhappy.

3. You owe the broker money. You are unhappy. (but do you have the cash at close hand to pay the difference?). The broker is unhappy as it has now effectively lent the investor money without even knowing whether you are able to honour your liabilities and may need to resort to court proceeedings to recover payment of its debt.

This problem is solved by the broker requiring a margin payment from every investor that wishes to trade in share CFDs. The risk management from the broker’s point of view is determining what the margin rate should be for the market under consideration.

There would be little basis for requiring an investor to deposit a full 100% margin for the underlying financial instrument, as the investor would then be better off buying the shares outright via normal shares dealing (and they wouldn’t incur daily financing charges). But of course a 0% margin isn’t possible as the broker would then have no protection. The correct answer would be somewhere in between with the margin rate being determined mainly by the liquidity and volatility of the financial instrument. Generally for blue-chip stocks (i.e. stocks quoted on main indices such as the FTSE 100, Dow..etc) margin rates can be 10% or less.

If an investor breaches his margin requirements, the broker would simply alert the client and if necessary close out a few or all of the positions to ensure the investor remains within his margin requirements. This logically requires the broker to have a good trading platform with a solid infrastructure in order to manage and control this hidden credit risk.

Note: When you have calculated your initial margin payment, you will need to ensure that when you place a trade you have sufficient money on your trading account to cover it. Note also that if your position starts to lose money and you do not have sufficient money in your account to cover the loss, you may also have to pay ongoing margin.

What does margin mean and how does it apply to CFDs? When you are trading on margin, you are essentially borrowing money equivalent to the consideration you’re trading in. A few weeks ago, my father was trading in Amec. The shares went up 10p and he made £100, because he was just buying the physical shares. Even though he’d got it right he wasn’t able to make a decent amount of money but if he’d bought a CFD he could have made five or 10 times that amount.

A good example is if you buy £15,000 worth of physical stock. It goes up to £20,000 worth and you’ve made 33.3%. But if you are trading through a CFD you are trading with 10% margin so the £15,000 that you just bought will only cost you £1,500, which is frozen in collateral. It goes up to £20,000 and you’ve made £5,000 profit against an initial outlay of £1,500. So in reality you’ve returned 333% on your initial capital.

Q:What is Initial Margin?

A: Every trader who wants to trade CFDs is required to put up an Initial Margin (deposit) for each contract they trade. Initial Margin refers to the initial deposit required to open a position. This applies to both buyers and sellers. This Initial Margin is returned when the contract is closed out. The amount is normally set at a level designed to cover reasonably foreseeable losses on a position between the close of business on one day and the next. For UK share CFDs, this ranges from between 5% to 50% of the whole notional value of the position. Thus, if you purchased 10,000 ABC CFDs at $1.45 and assuming a 10% initial margin deposit, you would be required to have not less than $1,450 within your account to cover the minimum margin requirement (10% of your total position size of $14,500). The margin requirement for index and forex CFDs is often as little as 1%.Example of the Mechanics of a CFD trade

An investor has been dealing in shares for a number of years and decides to start trading CFDs. He enquires with several CFD providers before deciding with which provider to open an account. The investor opens and funds his account and after doing some research on ABC PLC, he reckons that its stock price was presently undervalued. He thus decides to take a long position using a contract for difference over ABC PLC shares.

The prevailing price of one CFD contract over ABC shares being quoted by the CFD broker is $5. The investor accesses his trading account and places and order to buy 6,000 ABC PLC CFDs which order is accepted by the CFD provider at $5 per CFD. The total market value of the contract amounts to $30,000 ($5 x 6,000). The CFD broker has a 5% margin requirement on the stock so the margin equivalent to $30,000 x 5% = $1,500 deposit margin is deducted from the investor’s CFD trading account. The provider charges the investor 0.10% on the face value of the open and closing trades. To open this position, the provider would thus charge the investor $30 [0.10/100 x $30,000]. In the table below you can see how the price of the stock affects the investor’s return.

| If ABC’s stock price… | to… | Opening and Closing Commissions | Investor would gain/lose | Return on Capital (Initial Margin, %) |

| Rises by 20% | $6.00 | $66.00 |

$5,934.00 |

396% |

| Rises by 10% | $5.50 | $63.00 |

$2,937.00 |

196% |

| Rises by 5% | $5.25 | $61.50 |

$1,438.50 |

96% |

| Rises by 2% | $5.10 | $60.60 |

$539.40 |

36% |

| Stays the same | $5.00 | $60.00 |

($60) |

-4% |

| Falls by 2% | $4.90 | $59.40 |

($659.40) |

-44% |

| Falls by 5% | $4.75 | $58.50 |

($1,558.50) |

-104% |

| Falls by 10% | $4.50 | $57.00 |

($3,057) |

-204% |

| Falls by 20% | $4.00 | $54.00 |

($6,054) |

-404% |

*This example assumes that the investor is able to close his trade at the indicated price. Gains/losses and rate of return take into account commission charged at 0.10% on the face value of the opening and closing trades, but do not take into account financing fees for holding positions overnight (which in practice will affect your returns from trading CFDs).

Q:Right, but from whom do I borrow the money off for the rest of the position?

A: You borrow it from your broker which is why you are charged a financing fee for holding a position overnight. In actual fact, when trading a contract for difference you are effectively borrowing the whole amount of money, irrespective of the margin you put upfront – the initial margin only acts as a ‘guarantee payment’. So a $15,000 CFD position is the same as borrowing $15,000.Q:What margin is required for a CFD?

A: Margin is used to ensure that the broker can safely lend money to the investor knowing that the investor can meet any liabilities. A margin payment is required from every investor trading CFDs and the broker determines the margin rate, which is affected by the liquidity and volatility of the underlying asset. Typical margins lie in the 10%-15% range. With a margin of 10%, a contract for difference with a contract value of $10,000 will require a margin/deposit of $1000 (check with your CFD broker for other margins).One obvious advantage of trading on margin is that it can increase the exposure to an asset for an investor and also its price movements for a smaller amount of money relative to a standard trading account. On the other hand, trading with margin can lead to losses that may exceed the trader’s available balance. Therefore, when placing trades, enough money should be kept in the trading account to cover all trades made. Ongoing margin is sometimes paid when the trader has an open position that is losing money and the losses are not covered by the funds in the trading account. Irrespective of the margin sizes used, traders must always be aware that they have full responsibility of the full face value of any trades made.

Leave a Comment