Changes in UK tax regulation in the Summer of 2004 have opened up all the features and benefits of trading CFDs within a low cost SIPP* wrapper. Thereby trading Contracts for Difference (CFDs) within a SIPP is now permitted under current legislation provided the shares involved are traded on an Inland Revenue Stock exchange.

The Inland Revenue has confirmed that anyone holding a self-invested personal pension (Sipp) can invest in CFDs, provided they are linked to shares traded on a recognised stock exchange. However, losses must not exceed the portion of the fund allocated to CFDs.

Financial advisers and pension providers report that more and more people are using their pension fund money to trade in CFDs because the returns are more tax-efficient.

In order to trade cfds within your SIPP portfolio you have to simply inform your SIPP provider of your choice of broker or Investment manager, the SIPP provider then usually takes care of the necessary paperwork to open the trading account (forwarding on to you and documentation that requires your signature) and then inform you when the account is open. You would then instruct your SIPP Provider to transfer a proportion or the whole of your funds to a cash account with the broker and once complete you would then deal directly with the broker to place any trades. The only restriction is that the broker must be UK based and FCA regulated.

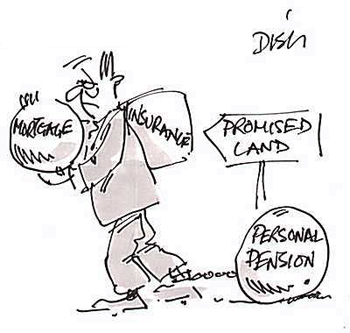

The benefits of using CFDs in a SIPP are significant in that you have the ability to gear up positions, not only for speculation and trading, but also as a means of hedging existing positions in your current SIPP portfolio. Having the ability to go short as well as long can and does make a real difference to trading performance. Your immediate reaction to using CFDs in a SIPP perhaps is that it seems crazy to gamble your pension using a derivative instrument that gives you significant gearing potential. The answer is simply that CFDs can be used to enhance your gains and should always be used in the context of a strict risk control policy. You have the option to split your SIPP fund so that part is in a CFD SIPP and part is in a traditional portfolio. That way you can have the best of both worlds, a traditional portfolio of stocks and shares as well as a CFD account that allows you to enhance your returns when you feel it is appropriate to do so, whether that be magnifying your exposure to a particular stock or index, or using a short position to either hedge an existing position or speculate on a stock being over valued.

Within a SIPP, investors can trade many times a day if they wish, or just once in a while should they be more passive. Indeed, in a difficult market, individuals have the ability to sit out thorny conditions by transferring into cash: a luxury rarely afforded to professional fund managers. And, given SIPPs’ tax-efficient environment, investors need not worry about capital gains tax liabilities when they sell at a profit.

Michael Fairweather of I-Sipp, a firm specialising in advising Sipp investors, says investing in CFDs through a pension ensures there is no capital gains tax to pay on any profit. In addition, investors receive tax relief on contributions paid into the pension fund.

Not all Sipp providers will allow customers to trade in CFDs, but Poynton York, James Hay and AJ Bell are among those that do.

Andy Bell, the managing director of AJ Bell, said that the firm was seeing rising demand for this type of investment. He said: “Provided the Sipp is set up correctly, there’s no reason why people can’t invest in CFDs. But it’s important to keep losses below the value of the CFD account in the Sipp. This would mean breaching Inland Revenue rules, and could jeopardise the entire Sipp.”

Investors can avert this danger by buying “stop-losses”, which close the CFD once losses have reached a pre-set level.

So in summary what are the benefits of a CFD SIPP?

- Using a CFD you pay no stamp duty, immediately saving you 0.5% per transaction.

- The ability to hedge existing market positions in your traditional portfolio or short stocks which you feel are over valued.

- The ability to use leverage both in short and long transactions.

- Low commission costs of around 0.2% which compares very favourably to traditional stock brokers that normally charge between 1% and 2% on both sides of the transaction. On a £10,000 trade this can save you several hundred pounds just in commission costs.

- You can have access to the Level 2 system giving you the ability to trade on the order book. A traditional stockbroker will always quote you the market spread which is far more costly. Yet another significant saving which if you are dealing in size could run into thousands during the course of a year.

- Flexibility: SIPPs provide full transparency in that you know exactly what you are invested in at any one time. There are not many pension fund companies that will be able to give you a detailed breakdown of how your funds are invested at any one time.

CFD Sipps for Traders

For the active trader, all the usual tools of the trade will be available for buying and selling. If your chosen execution-only site usually has a full range of order types, it will also have them for trading within a Sipp.

Hargreaves Lansdown is developing stops, limits etc at the moment as part of its overall stock broking offering. It plans to launch them within the next three to six months.

iDealing has the usual limit order capacity of 90 days in the order book and can keep orders in its own order management system for up to two calendar years.

‘People in our Sipp can use stops, stop limits, stop loss limits and stop buy limits and each of their orders can trigger under different conditions,’says Duckworth.

‘They can also submit a condition that says, for example, they want to buy a bank and have three or four to chose from – if one of the trades is executed, it cancels the others. And they can access start-of-day and end-of-day SETS auctions.

The availability of order types is particularly pertinent to Sipp holders wishing to use CFDs. Since 2004, when these instruments were allowed as Sipp investments – provided they relate to shares traded on a recognised stock exchange – several providers, including IG Markets, have set up CFD Sipps. Investors can separate a CFD Sipp from a trading or investment Sipp, using the CFD portion for hedging the investment portion or speculating. The rules are that there must be enough in the CFD Sipp tocover any potential losses, which obviously with margin trading can be much larger than the initial amount. Those wishing to open a CFD Sipp must sign a risk form indicating that they are intermediate customers as defined by the FCA.

Using CFDS in a SIPP correctly and with a sound risk monitoring framework can help you to achieve better returns form your SIPP over time which you would otherwise not be able to do in its traditional form.